HSA, HRA, FSA and DCFSA

HEALTH SAVINGS ACCOUNTS (HSA)

Administered by Cigna

By selecting a High Deductible Health Plan (HDHP) with Health Savings Account (HSA), you can contribute tax-free money into your HSA that allows you to earn tax-free interest that can be used to pay for qualified health care expenses tax-free. Triple Tax Advantaged!

By selecting a High Deductible Health Plan (HDHP) with Health Savings Account (HSA), you can contribute tax-free money into your HSA that allows you to earn tax-free interest that can be used to pay for qualified health care expenses tax-free. Triple Tax Advantaged!

The HSA Contributions for 2025 have increased. Associate only coverage $4,300. Associate + Dependent(s) coverage $8,550. To be eligible to contribute to a HSA, you must be enrolled in a HDHP, you cannot be enrolled in Medicare, you cannot be enrolled in other coverage, and no one can claim you as a dependent on their tax returns.

RESOURCES

|

|

Health Savings Account | |

| When can I use the funds? | Funds are available as you contribute to the account. | |

| Can I roll over funds each year? | Yes, funds roll over from year-to-year and are yours to keep (even if you leave the company). | |

| How do I pay for eligible expenses? | With your Cigna HSA Bank debit card You can also submit claims for reimbursement online at www.myCigna.com |

|

| How much can I contribute each year? | You can contribute $4,300 for individual coverage or $8,550 for family coverage (this total includes employer HSA contribution). | |

| Will I receive an employer contribution to this account? | Yes. Equity Trust will contribute $500 per year for those enrolled in associate only coverage, and $1,000 per year for those enrolled in associate + dependent(s) coverage. Employer contribution for new hires will be pro-rated. All funds are available immediately upon plan start date. | |

| Can I change my contributions throughout the year? | Yes, notify the Benefits Specialist to change semi-monthly HSA contributions at any time during the plan year. | |

| Do I own the account? | Yes, if you were to change jobs the account goes with you. There are no fees to transfer or roll the HSA out of the Equity HSA plan. | |

| EMPLOYER HSA CONTRIBUTION AMOUNT | ||||

| ENROLLMENT MONTH | MONTHS OF COVERAGE | SINGLE | FAMILY | |

| January | 12 | $500.00 | $1,000.00 | |

| February | 11 | $458.33 | $916.67 | |

| March | 10 | $416.67 | $833.33 | |

| April | 9 | $375.00 | $750.00 | |

| May | 8 | $333.33 | $666.67 | |

| June | 7 | $291.67 | $583.33 | |

| July | 6 | $250.00 | $500.00 | |

| August | 5 | $208.33 | $416.67 | |

| September | 4 | $166.67 | $333.33 | |

| October | 3 | $125.00 | $250.00 | |

| November | 2 | $83.33 | $166.67 | |

| December | 1 | $41.67 | $83.33 | |

| 2025 PLAN YEAR ANNUAL CONTRIBUTION LIMITS |

||

| Single | $4,300 | |

| Family | $8,550 | |

| HSA Catch-Up Contribution (age 55 yrs and older) |

||

| $1,000 | ||

HEALTH REIMBURSEMENT ACCOUNTS (HRA)

Only available to associates participating in Tricare or Medicare.

Only available to associates participating in Tricare or Medicare.

Administered by Cigna

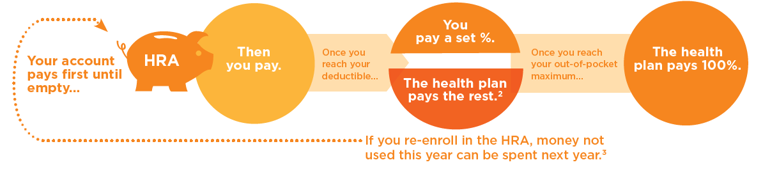

Associates participating in Tricare or Medicare are eligible to select the High Deductible Health Plan (HDHP) with Health Reimbursement Account (HRA). The Cigna Choice Fund HRA provides a health reimbursement account funded by your employer to help pay for some of your covered health care costs.

When you receive health care services, your HRA can be used first to pay 100% of your eligible health care costs with the money funded from your employer. These costs will count towards your annual deductible. Any unused money can be rolled over to the following year if you remain in the plan.

| 2025 PLAN YEAR EMPLOYER HRA CONTRUBTION AMOUNT |

||

| Single | $500 | |

| Family | $1,000 | |

HEALTH CARE FLEXIBLE SPENDING ACCOUNT

Only available to associates participating in the HRA plan.

Only available to associates participating in the HRA plan.

Administered by Cigna

The Health Care Flexible Spending Account allows you to set aside up to $3,300 on a pre-tax basis that you can use to pay for certain out-of-pocket health care costs for you, your spouse, and your eligible dependents.

You will receive a Visa debit card to pay for qualified health care expenses throughout the plan year. Eligible health care expenses include prescriptions, copays, coinsurance, and other qualified expenses as outlined below and on the Cigna website. You cannot stop or change the amount deducted from each paycheck unless you experience a qualifying event. You may be eligible to carry over up to $660 of unused funds to the following plan year.

Please note only associates enrolled in HRA plan can elect a Health Care FSA. If you are enrolled in either of the HSA plans you are not eligible for the Health Care Flexible Spending Account.

ELIGIBLE EXPENSES FOR HSA OR FSA REIMBURSEMENT

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can be great cost-savings tools. You can use them to reimburse yourself for eligible health care, dental and dependent care expenses. The following is a partial list of expenses that are reimbursable tax-free with a HSA or FSA. For a complete list, visit the IRS’s website at www.irs.gov and search for “Section 213” expenses or visit the Cigna website at https://www.cigna.com/qualified-health-care-expenses for the full listing of HSA and FSA eligible and ineligible expenses. It’s also important to keep a record of the expenses you pay with your HSA or FSA in case Cigna asks you to prove that an expense was eligible for reimbursement from your account, or in case you are audited by the IRS. Examples of records you should keep include: receipts, Explanation of Benefits (EOB), medical diagnosis/physician diagnosis letters, and prescriptions. Please note that the list is subject to change based on regulations, revenue ruling, and case law.

|

|

![]() Don’t miss out on the chance to save money on health care expenses!

Don’t miss out on the chance to save money on health care expenses!

Enroll in the HSA or FSA

Use Cigna’s HSA Calculator Tool to see how much you can save by choosing a health savings account:

http://www.hsabank.com/cigna/home

Use Cigna’s FSA Calculator Tool to see how much you can save by choosing a flexible spending account:

http://www.cigna.com/personal/health-and-well-being/tools/fsa-calculator/

DEPENDENT CARE FLEXING SPENDING ACCOUNT

Administered by Cigna

The Dependent Care Flexible Spending Account offered through Cigna is a convenient way to plan and pay for eligible dependent care expenses. Eligible dependents include children aged 13 and under, or disabled dependents of any age. The expenses must be necessary to enable you to work. If you are married, your spouse also must work, be a full-time student at a qualified educational organization during each of five calendar months during the taxable year, or be physically or mentally handicapped.

For 2025, you can contribute up to $5,000 if you are married and filing jointly, or $2,500 per person if you are filing separate tax returns.

Below is a list of eligible expenses that qualify for reimbursement from the Dependent Care FSA. You’ll also find examples of expenses that do not qualify for reimbursement because they are not considered legitimate deductions for federal income tax purposes. To see a full list of IRS-qualified dependent care expenses, visit the Cigna website at www.cigna.com/dependent-day-care-expenses

| ELIGIBLE EXPENSES | INELIGIBLE EXPENSES |

|

|

CLAIMS

You can submit your claims online at mycigna.com. Once you are registered and logged in, you can view your account balance(s)

Email Katie Plush ([email protected]) or Vicki Barone ([email protected]) if you have any questions about the benefits or online enrollment process.